Return to flip book view

Message 1DSunday, January 28, 2024

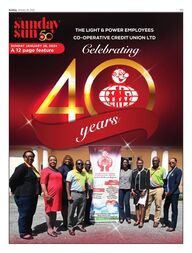

2DSunday, January 28, 2024Stories by CHERYL HAREWOODHEN the annals of the Light & Power Employees Co-operative Credit Union Limited are written, names such as Lieutenant Colonel Trevor Browne, Julie Alleyne, Orville Carter, Freddie Adamson, Claude Franklin, Austin Williams, Cheryl King, Oliver Jones, Darren Brooks and Keith Richards will be recorded as the founding members of this now vibrant cooperative.From an idea to a credit union with close to 2 000 members, a loans cap of $700 000 per member, and $65 million in assets, the Light & Power Employees Credit Co-operative Union Limited has grown in leaps and bounds.The credit union was birthed at a time when many other credit unions were either in their embryonic stage or had been established just months earlier or later.It was registered as a co-operative on January 11, 1984, making it 40 years old this month. At its registration, it had a membership of approximately 40 members – all of whom were employees of the Barbados Light & Power (BL&P) Company Limited. In fact, the credit union was the brainchild of the employees of this utility company, and its “home” consisted of a space within the Bay Street, St Michael establishment.Originally founded to meet the needs of the growing staff of the BL&P Company Limited and their families, the credit union threw open its doors some years later to welcome members of the public. It has now welcomed businesses and persons located within a five-mile radius of its headquarters at Bush Hill, The Garrison, St Michael. The view was held by credit union management at the time that such an invitation would have provided the financial institution with whatever resources it needed to cater to its growing membership base which included employees of Sagicor, the Barbados Defence Force, the Hilton Hotel, Caribbean Examinations Council, Fund Access, Rubis, Guildan Activewear and the Hilton Hotel – to mention a few.The management of the credit union worked long and hard to offer the best products and services to its members and to grow the credit union financially.By 1994, the credit union had a membership of 834, which was considered significant growth for a small cooperative. Loans had totalled BDS$4 million and the credit union’s assets were a then whopping BDS$ 6.5 million. Within its first decade, the credit union had established restaurants, a service station, helped in the formation of an insurance company, and acquired real estate along the way.Audited records showed that by the end of 2015, the Light & Power Employees Co-operative Credit Union Limited had a membership of 1 745 members, and its share capital was BDS$5.53 million. The figures also revealed loan balances of $30.54 million; total assets of $47.42 million and net revenue for the year was $0.513 million. At the end of 2015, the credit union ranked sixth in terms of assets among all credit unions in Barbados. With expertise, efficient and dedicated staff, and thanks to the confidence of its members, the credit union has undoubtedly evolved into a major partner in the local credit union movement.Unafraid to take financial business risks, management continues to this day to carry out careful screening of potential borrowers, its internal control procedures, and has a diversified range of assets which guard the credit union’s financial stability.The Light & Power Employees Co-operative Credit United Limited continues to live up to its motto: Committed to Total Member Customer Satisfaction, and can be reached by calling 431-1400; emailing info@lpecu.bb, or by fax number: 228-4643.The institution’s hours of business are Monday to Thursday 8 a.m - 4 a.m; Friday 8: a.m to 4:30 p.m.Congratulations toLight & Power Employees’ Co-operative Credit Unionon theirCongratulations toLight & Power Employees’ Co-operative Credit Unionon theirCommitted to total customer satisfactionTHE HEADQUARTERS OF THE Light & Power Co-operative Credit Union Limited at Bush Hill, The Garrison, St Michael. (Pictures by Lennox Devonish.)

3DSunday, January 28, 2024Message from Reginald Parris, Chairman and President (Ag) of the Light & Power Employees Co-operative Credit Union Limited, to mark its 40th anniversary.PEOPLE HELPING PEOPLE, not for profit, not for charity, but for service”. From humble beginnings 40 years ago, some engineers teamed up with a meter reader, and that is how the Light & Power Employees Co-operative Credit Union Limited was born.Those few could not have imagined in 1984 that the credit union they started with a handful of keen and focused staff members of the Barbados Light & Power (BL&P) Company could have achieved so much 40 years later; a credit union which is holding its own among other financial institutions across the island and is known to uphold the philosophies of the credit union movement.For over 40 years, the Light & Power Employees Co-operative Credit Union has worked to make the financial marketplace a better one for its members. The management and staff have worked hard to empower members by clearly identifying our objectives and working with our members to help them realise their goals. It is a great pleasure for us to be here to celebrate our 40th anniversary and to thank you, our members, for all that you have done to make the Light & Power Employees Co-operative Credit Union an excellent place to do business.Today, we live in a time of austerity, strained budgets, and deep deficits. We have grown out of a biscuit tin, coming through several challenges, inclusive of the COVID-19 pandemic, and we continue to remain a sustainable organisation which exceeds our members’ expectations. Over the period, our membership has grown to over 2 000 with assets of almost $65 million.Our past has had both milestones and challenges. We were able to move from borrowed space to owning our own building, located at the Business Complex, Bush Hill, The Garrison, St Michael. Our bond has been opened and we are no longer restricted to only employees of the Barbados Light & Power (BL&P) Company Ltd but to the entire nation of Barbados. Thanks for all your supportREGINALD PARRIS, Chairman and President (Ag). (SLD)BOARD OF DIRECTORS: (Back row, from left), David Lawrence, Erwin Jones, Kelvin Whittaker. (Front row, from left), Tracia Seifert-Licorish, Reginald Parris, Keisha Morris. (SLD)WHY CHOOSE BTCCUL FIXEDDEPOSIT• Competitive Interest Rates• Secure and Reliable• Flexible Terms• Member-Centric ServiceTO THE LIGHT & POWER EMPLOYEES CO-OPERATIVE CREDIT UNION LTD.EMPOWER YOUR FINANCIAL FUTURE WITHTHE BARBADOS TEACHERS’ CO-OPERATIVECREDIT UNION LTDBTCCUL FIXED DEPOSIT INTEREST RATESUNLOCK FINANCIAL FREEDOMCONTACT US TO OPEN YOUR FIXEDDEPOSIT ACCOUNT: INFO@BARTEACHCREDIT.COM[Disclaimer: The advertised interest rates are for illustrative purposes only and may be subject tochange. Please contact BTCCUL for the latest rates and terms. This advertisement is for promotionalpurposes and does not constitute financial advice.]Celebratingyears Congratulations to the Light and Power Employees Co-operative Credit Union Ltd on 40 years of unparalleledservice to its members! The UWI Credit Union wishes you many more years ofsuccess! Facebook: UWI Cave Hill Co-operative Credit Union Limited Email: creditunion@cavehill.uwi.edu Tel: (246) 417-4716 or 417-7550 Visit our website: www. cavehill.uwi.edu/creditunion Our credit union has expanded and is involved with the community. It offers the Trevor Browne Scholarship and the Julie Alleyne 11-Plus Awards, named after two of our founding members. The credit union has advanced to offer online same-day banking facilities and Surepay services.Training and development are essential to engaging our employees, as it enables them to provide our members with the best possible member service. We also have talented staff who will continue to provide the latest products to make your financial future bigger and brighter.Forty years have passed, and we must decide, where we go from here. Our goal is to utilise a variety of tools to grow our membership and improve every aspect of our business. We recognise the changing demographics and what is ongoing in the marketplace. As we look to expand and improve our products and services and usher in new technological advances, we must also increase security measures. We will work with our strategic partners to address key issues which may impact us on a micro and macro level.As we reflect, we want to take this opportunity to say thank you to all those individuals who have helped us to reach this far. You know who you are, and we sincerely appreciate the hard work and dedication which you have provided. We extend a special thank you to the Barbados Light & Power (BL&P) Company Limited for your support over the years and to all our key shareholders.

4DSunday, January 28, 2024S THE Light & Power Employees Co-operative Credit Union Limited embarks on its 40th anniversary, Operations Manager Andrea Marshall-Harris commends staff and members for their stewardship over the years and envisions a continued bright future for the credit union.Marshall-Harris, who was appointed to this new post earlier this month, believes that with the average employee having spent some 20-plus years with the credit union, staff and members must be congratulated for their commitment and dedication over the years.“The credit union did not reach its 40th year without having our vested staff and indeed, our vested membership. Staff members on average have been with the credit union for 20 years or more. In fact, we have staff who have been with us for 35 years and credit union members who have been with us from day one. In addition, having an organisation that offers a different level of personalised service is a plus. We are, essentially, a small credit union – with close to 2 000 members, so we always aim to offer that personalised service which is second to none. We want to continue to do this in the future and be known for offering this kind of service. This is an area I will be focusing on going forward,” Marshall-Harris stressed.She added, “We will also be looking at the products and services that we offer, to see how we can improve on those.”“The future of the economic landscape is unpredictable, and consumers are challenged with a very uncertain job market. Operating in an environment coupled with negatives and positives presents the credit union with opportunities to improve its products and services, enhance its website, and generally, to reflect upon its operational deficiencies.”Marshall-Harris added, “Throughout 2024, our team will be seeking to connect with new and existing members as well as to enhance our community initiatives. The Light & Power Employees Co-operative Credit Union Limited is open to everyone, and not only to employees of the Barbados Light & Power (BL&P) Company Limited.”With over 20 years’ experience in the financial services sector, and having previously worked in insurance, risk management, and compliance, Marshall-Harris, who brings a wealth of experience to her new role, disclosed that the vision of the Light & Power Employees Co-operative Credit Union Limited still continues to be that of a credit union with a primary focus on satisfying the needs of its members.She shared, “As I look towards the future, the vision is to have a credit union that members want to turn to for all their banking needs. It is to continue to offer members a family-oriented environment and to grow the business. “Our mission statement states that we are a dynamic service provider, and we will aim to come up with a well thought-out, embraced, and executed strategic plan to move the credit union forward. Having an inclusive organisation which looks at the needs of staff and members is important to how we conduct our business,” the credit union head further stressed.Marshall-Harris spoke of the members’ commitment to the credit union.She noted, “Some members say we are their only institution for banking. Over the years, the credit union has accomplished much and has done quite a bit, making changes to better serve our members. We have moved to online banking and have introduced the services of Surepay. With online banking, members enjoy same-day transfers, and we have a strong drive for members to save, even while they are repaying loans.”Marshall-Harris oversees the overall day-to-day management of the credit union and manages a team of nine. She is responsible for the smooth and efficient daily operations of the organisation, oversees staff and training, develops strategic plans, recommends and implements policies, and works collaboratively with the Board to execute the goals and objectives of the organisation, which has BDS$65 million in assets. (CH)Our service is second to noneANDREA MARSHALL-HARRIS, Operations Manager. (SLD)

5DSunday, January 28, 2024he name Lieutenant Colonel Trevor Browne has been synonymous with the business world, particularly co-operatives, sports, and engineering in Barbados for many years.President of the Barbados Sustainable Energy Cooperative Society Ltd (Co-op Energy), and the Barbados Association of Professional Engineers (BAPE), Browne was the main driving force behind the birth of the Light & Power Employees Co-operative Credit Union Limited, which was born out of the Reddy Kilowatt Co-op Society Limited, the latter having been established in 1980.Recalling the start-up of the credit union back in 1984, Browne shared, “The consumer co-operative was born first, then the credit union about five years later, and I was the president of both the co-operative and the credit union for the first 15 years.”Browne, an engineer, added, “We [the staff of the Barbados Light & Power (BL&P) Company Limited started the credit union after one employee had difficulty getting a loan from the banks.“Back then, there were ten people listed as founding members. Along with myself, there were Julie Alleyne, Orville Carter, Freddie Adamson, Claude Franklin, Austin Williams, Cheryl King, Oliver Jones, Darren Brooks and Keith Richards, all employees of the Distribution Department at the BL&P Company Limited.“We started with zero assets. Eventually, the staff from the BL&P and their families came together and joined the credit union. When we had exhausted the BL&P staff members, we then opened the credit union for other people to join”.According to Browne, “The Light & Power Employees Co-operative Credit Union Limited has always been innovative. It was the first credit union to be fully computerised, with some other credit unions then adopting our software.”Interestingly enough, the software was created by Browne. He stressed, “It was when credit unions in Barbados became computerised that growth escalated and accelerated. For many, their growth skyrocketed.“We were also using our own credit cards long before the local banks were doing so, and when we purchased our first building, we had raised some $800 000 among ourselves through the issuing of bonds to finance it. We had good support from the BL&P Company Limited and from members,” Browne disclosed.He further added, “The Light & Power Employees Co-operative Credit Union Limited has always been seen as a key player in the credit union movement. What we brought to the credit union movement in Barbados has been phenomenal in terms of technology and management.”While Browne has not sat on the credit union’s Board or any of its committees since the 1990s, he played key roles as the first president during the credit union’s first ten years in operation, and was the first president of the Reddy Kilowatt Consumers Co-operative for 15 years. He was also president of the Barbados Co-operative Credit Union League from 1989 to 1994, and founding president of the Co-operators General Insurance Company which was born out of the credit union league.About the operations of the credit union, he informed, “The Light & Power Employees Co-operative Credit Union Limited has always had a high savings ratio. Today we have approximately $65 million in assets, and a membership of around 2 000.Browne contends, “I think the credit union movement is the ultimate form of organisation. It brings about solutions and ideas. It is the cooperative type of business where the owners are the ordinary people. They own the assets. Today the credit union movement in Barbados has assets in excess of BDS$3 billion, and this is a great achievement. This tells you of the power of co-operatives. I truly enjoy being a part of the movement.”As he spoke of what the Light & Power Employees Co-operative Credit Union Limited has achieved through the years, Browne made mention of the entity’s scholarship programme which bears his name, namely the Trevor Browne Scholarship. This was started some years ago for relatives of members who sit the Eleven Plus Examination, as well as those going on to tertiary level educational institutions.“The young people who benefit from this scholarship go on to become members of the credit union and are often very keen on learning more about the credit union movement. I am proud to have this scholarship named in my honour,” Browne shared.Today Browne is proud of the credit union’s many achievements.“I am extremely proud of the success and the progress the Light & Power Employees Co-operative Credit Union Limited has made. I am especially impressed with the demonstrated high level of management skills over the years. This has resulted in the credit union’s impressive growth,” Browne said. (CH)LPECCUL a trailblazer in the movementLIEUTENANT COLONEL TREVOR BROWNE, founding member of the Light & Power Employees Co-operative Credit Union Limited. (FP)

6DSunday, January 28, 2024T IS EASY for Julie Alleyne to reflect on her early years as an employee of the Barbados Light & Power (BL&P) Company Limited, and as a founding member of the Light & Power Employees Co-operative Credit Union Limited.She looks back with fondness to 1980. That’s when the consumer co-op was formed. This came about after her co-worker, Lieutenant Colonel Trevor Browne, broached the idea of starting a consumer co-op in the company.According to Alleyne, “A group of us got together to purchase snacks for our break-time. From this, it was clear that a co-operative would be a brilliant idea or concept where we could collectively purchase items. I immediately agreed with the idea because my father was a member of a co-op; hence, I was aware of the benefits that could be derived.“We set about informing employees of our thoughts, and started proceedings to get the co-op in operation.“The Light & Power Employees Co-operative Credit Union Limited was therefore born in 1984, out of the co-op, Reddy Kilowatt Co-op Limited,” she added.Alleyne also recalled how the BL&P Company Limited’s management would grant the founding members time to attend planning meetings, and how the Registrar of Co-ops arranged for the members to have a meeting with personnel from the International Labour Organisation (ILO), who were visiting the island at that time.“We were able to gain some valuable knowledge and tips about managing the co-op,” Alleyne said.As secretary, Alleyne managed the accounting before Browne set up an accounting system on his own. She became the credit union’s first secretary and later its first female manager.Management was gracious, and thanks to her manager Claude Franklin and the management team, Alleyne was seconded to the credit union for a period to help with its growth.“After two years, I was given the opportunity to continue in the position as a full time manager of the credit union, but I declined,” said Alleyne who, back then, was administrative assistant to the distribution manager.She shared, “In a few short years we were able to achieve 100 per cent membership. The first member to join was Mark King, and he was followed by other senior staff.”Alleyne further recalled, “Most of the credit unions in Barbados at that time were being birthed; that is, around 1984 and 1985, and people were finding it beneficial to join these credit unions because of the loans systems they had in place. You could join and have access to a loan within three months. Back then, getting loans from banks was not as easy as it is today.”Alleyne has described Browne as a forward thinker who, was “always thinking of innovative ways to improve the credit union’s service”.She shared, “He introduced the idea of offering bonds to members in order to be able to purchase the building at the corner of George Street and Collymore Rock, St Michael. The credit union was able to complete the purchase in a few years’ time.“As the credit union grew, provision was made for employees to invite their family members to become members. Later, an invitation was extended to those persons working within a five mile radius of the BL&P Company Limited.”In hindsight, Alleyne can proudly say, “The credit union movement in Barbados was a great idea in those days in helping employees to grow financially. Our management at the BL&P was on board from day one, and this helped members to secure loans, improve their status and their living conditions. When the banks realised that credit unions were growing at a fast rate, they sought to improve on their service to customers.“Today the credit union is still offering the services it did back then in the 80s and 90s, but new services and products have been added to better serve members,” Alleyne affirmed.Our best days are still aheadPERHAPS YOU ARE WONDERING how to become a member of the Light & Power Employees Co-operative Credit Union Limited.Here’s how: Firstly, membership is voluntary and is open to all persons living and working in Barbados. Be sure to visit the the credit union’s office located at Bush Hill, The Garrison, St Michael, where you will be assisted with filling out your membership application forms.Secondly, you are required to have the following:• Two forms of valid photo identification:• Driver’s Licence• Passport• Government-issued identification card• Tax Payer Registration Number (TRN)• Proof of residence (any one of the following are acceptable): • One utility bill • Two most recent rent receipts (if making rental payments)• Job letter or recent pay slipThe minimum of funds required to start membership:Permanent Qualifying Shares (Compulsory): Value of BDS $100 plus BDS$5 membership fee. (CH)Become a memberJULIE ALLEYNE, founding member. (GP)KELVIN WHITTAKER HAS the distinction of being the longest-serving committee member and longest-serving president of the Light & Power Employees Co-operative Credit Union Limited, having served at various intervals.This loyal, dedicated, and committed credit union member for over 35 years has sat on both the supervisory and credit committees and has performed the role of vice president intermittently throughout the years.In retrospect, as he relived those early years, Whittaker informed, “It was [Lieutenant Colonel] Trevor Browne who encouraged me to join the credit union, through Freddie Adamson. I was a junior staff member at the Barbados Light and Power (BL&P) Company Limited at the time, and he [Browne] was a senior engineer.”Whittaker shared that senior management and employees of the BL&P Company Limited wasted no time in joining the financial institution and worked relentlessly in their efforts to significantly “push membership”.He also recalled that Browne was the credit union’s first chairman, as well as the first chairman of the Co-operators General Insurance Company, which was also born out of the credit union movement.Following in Browne’s footsteps, Whittaker who currently serves as Chairman of Co-operators General Insurance, has described the credit union movement in Barbados as “a blessing”.He disclosed, “There are many of us who can show what we have achieved over the years when we could not get loans from banks. Many people have been able to improve their livelihoods, purchase homes, vehicles, enhance their education, and provide for their children because of the credit union movement.”He added, “A lot more can still be done. Through the emergence of the credit union movement, the insurance company was established over 30 years ago, and just recently, Browne, who is also President of the Barbados Sustainable Energy Co-operative Society Limited, took over the operations of the Barbados Agricultural Management Company, (BAMC) under Co-Op Energy, a company created by the credit union movement to oversee the management, production and sale of sugar.”“I am also a founding member of Co-op Energy.“The credit union has made a difference to us. Looking back, I can say it has also changed considerably, and this is expected.“Our first loan amount in the early days was BDS$4 000. It then went to BDS$12 000. At some point we were able to offer members up to BDS$300 000, and now we offer BDS$700 000, with a membership of around 2 000, and some BDS$65 million in assets,” the shrewd businessman said.The former vice president of the Barbados

7DSunday, January 28, 2024AS BOARD ADVISOR Sheena Edwards plays a pivotal role in the day-to-day affairs of the Light & Power Employees Co-operative Credit Union Limited.Edwards first joined the credit union in 2007, fresh out of the University of the West Indies, Cave Hill Campus. She held the posts of accounts clerk and business support officer before packing her bags in 2013 and heading to Trinidad and Tobago, where she was appointed branch manager at the Tobago branch of the COPOS Credit Union Co-operative Society Ltd.After six years abroad, Edwards returned to Barbados in 2019. In 2021, she returned to the credit union as a volunteer serving on the Board of Directors. She was selected to become both president/chairman of the credit union, serving as president up until October last year. Strategic changes at the financial institution saw Edwards becoming Advisor to the Board in August 2023 until the end of January 2024. This involved the oversight of the management of the organisation prior to the appointment of the new Operations Manager, Andrea Marshall-Harris.Edwards believes that the credit union has plenty to offer its members, including incorporating green and energy loans, in keeping with world trends to go green, and the credit union’s increased line of credit facilities.She shared, “Our line of credit facilities have increased and have become more accessible to our members. We have also made adjustments to our interest rate, thereby making it more attractive to members. Over the past three years, we have introduced online banking facilities to include Surepay, and we have also made it easy for members to transfer funds to other financial institutions.”The hosting of pop-ups, loan fairs, and Market Day, which allowed members and non-members to advertise their products, have also been strategic means for the credit union to increase its membership.“The truth is, we have great potential to further develop not just our credit union and to increase its membership but to develop our products and strategic initiatives through our community outreach, partnerships, and membership education, as we seek to further develop our youth arm of the credit union to become a more sustainable and relevant organisation through succession planning and encouraging volunteerism,” Edwards disclosed.“The credit union is here to promote financial wellness and encourage wealth creation amongst our membership through ongoing educational forums,” Edwards added. (CH)KELVIN WHITTAKER, longest-serving president, committee member. (SLD)PERHAPS YOU ARE WONDERING how to become a member of the Light & Power Employees Co-operative Credit Union Limited.Here’s how: Firstly, membership is voluntary and is open to all persons living and working in Barbados. Be sure to visit the the credit union’s office located at Bush Hill, The Garrison, St Michael, where you will be assisted with filling out your membership application forms.Secondly, you are required to have the following:• Two forms of valid photo identification:• Driver’s Licence• Passport• Government-issued identification card• Tax Payer Registration Number (TRN)• Proof of residence (any one of the following are acceptable): • One utility bill • Two most recent rent receipts (if making rental payments)• Job letter or recent pay slipThe minimum of funds required to start membership:Permanent Qualifying Shares (Compulsory): Value of BDS $100 plus BDS$5 membership fee. (CH)Become a memberGreat potential for developmentSHEENA EDWARDS, Board Advisor. (SLD)RIA-ASHLEE REIFER, Administrative Assistant to the Credit Union Manager. (GP)DEMARIO TAYLOR, General Worker. (GP)ACCOUNTS TEAM: (From left), Sophia Boyce, Paul Blackman, Hazelana Mason. (SLD)Co-operative & Credit Union League Limited (BCCULL), and board member of Reddy Kilowatt Co-operative Society Limited, also believes that small credit unions like the Light and Power Employees Co-operative Credit Union Limited, should merge their operations with equally small credit unions.“It can be costly, since the regulatory framework in place does not distinguish between large and small credit unions. The number of credit unions within the credit union movement can be reduced to make things so much easier for the betterment of the credit union movement and for members.”Whittaker added, “It is hard for us to become a 10 000-membership credit union, and there is currently lots of duplication within the credit union movement. There are some smaller credit unions which cannot match us in terms of our products and services, but I think that we must look for the best governance within the credit union movement.”Whittaker further stressed, “The Light & Power Employees Co-operative Credit Union Limited has been very good to its members. We were formed out of our own co-op, Reddy Kilowatt Mini Mart, and today, the child, which is the credit union, has grown by leaps and bounds. I hold the view that anybody and everybody in Barbados should be a member of a credit union. That’s my belief.” (CH)

8DSunday, January 28, 2024HE CREDIT UNION movement continues to play a very important place in the financial landscape of Barbados, and Rhe-Ann Niles-Mapp is quite happy to see that Barbadians are vested in the movement and continue to join the credit union of their choice.Notwithstanding, Niles-Mapp believes “it is important” that credit union management and members continue to stick to the basis on which credit unions were formed; that is – “members helping members.”She also holds the view that “As credit unions grow and match the services offered by other financial institutions, they must continue to meet the needs of their members, and always ensure they put their members first.”Niles-Mapp, who is chairman of the Supervisory Committee of the Light & Power Employees Co-operative Credit Union Limited has always embraced the family-oriented manner in which members of this credit union relate to each other.She opined, “The Light & Power Employees Co-operative Credit Union Limited has always been more of a “family-like” credit union, and over the years, I have encouraged my own family members to join. Even with membership growth, we have maintained this “family-like” atmosphere and environment, where people greet you by name when you are conducting business,” Niles-Mapp stressed.What she would also like to see is more young people join the credit union – a dream expressed by both staff and members of the organisation. However, for Niles-Mapp, it goes a bit further than that. She wants to see more young people playing active roles within the movement.“What I would really like to see is more young people getting involved in the Light & Power Employees Co-operative Credit Union Limited and serving in different capacities. It’s okay for them to join, but it would be good if they become active members and get to know more about how the credit union really functions,” said Niles-Mapp.A business systems analyst at the Barbados Light & Power (BL&P) Company Limited, Niles-Mapp joined the Light & Power Employees Co-operative Credit Union Limited just over a decade ago. It was her first time joining a credit union, but she has long understood the importance of serving. She has served on the supervisory committee for the past three years, which acts as an oversight for the credit union and its Board of Directors.The committee, which comprises Allana Goodridge (secretary), and members, Carla Pope-Lawrence, Joan Griffith, and Lionel Maxwell, carries out its share of checks and balances to ensure the credit union’s operations are “up to expectations”. In addition, committee members receive and investigate member complaints, as well as review the institution’s processes and policies to determine where improvements can be made. (CH)More youth needed to join movementRHE-ANN NILES-MAPP, Chairman of the Supervisory Committee. (SLD)admin@freespiritcommunication.net

9DSunday, January 28, 2024“I AM PROUD that we have grown from where we were when we started as a small department within the Barbados Light and Power Company Limited, offering small loans to staff members.”With these words, Credit Officer Ricardo Moore exuded a measure of satisfaction and pride in having seen the Light & Power Employees Co-operative Credit Union Limited grow in leaps and bounds.He disclosed, “We started out giving small loans of a few thousand dollars. We can now give mortgage loans of up to $700 000. This is a big achievement,” Moore disclosed.“Some 40 years from now I hope we will be much bigger and stronger,” he added.Moore has even greater “in the near future plans” for the credit union. He hopes that within the next ten years, it will be among the top five credit unions on the island.“We came from a strong base of employees at the Barbados Light & Power (BL&P) Company Limited. With their saving acumen, a strong financial foundation was created. Now we must continue to push on.“I am proud that we have grown from where we started in 1984, to where we are today.”Moore, a former night auditor in the tourism industry, disclosed that he had always possessed an interest in the credit union movement, due primarily to the fact that “it was indigenously owned”.When the opportunity arose for him to apply for the post of member services officer at the credit union, he applied for the post, was successful, and joined the credit union’s team on the first working day in January 2005. In 2006, he was promoted to his current post.He also made the decision to give up his membership at one of Barbados’ larger credit unions to become a member of the Light & Power Employees Co-operative Credit Union Limited – a move he has not regretted.He shared, “What I preferred about the Light & Power Employees C-operative Credit Union Limited was that it provided more of a family-type atmosphere. The core value of looking out for the best of all members still stands, and from back then, to this day, all decisions pertaining to the credit union are made in the interest of all members.”Moore explained that from its early days, plans were being made to improve on the credit union’s products and services. Today he can proudly state, “Our interest rates have dropped, the credit union movement has become more competitive, but overall, the services and products offered are much better.”He recalled those days when loans of only up to $300 000 were available to members. All members now have the ability to apply for loans on their account up to $700 000. The credit officer informed that back in the early 2000s, members were both saving and borrowing. Today, he stated, members are not as driven to save as back then when they were allowed to make income tax claims regarding their savings and loans.“The tax incentive is not there anymore, and persons are not saving like before. What we have done to rectify this and to encourage more savings is we have officially introduced a savings component to loan agreements. This encourages members to save while repaying their loans. Our members know that we always do what we do with their best interest in mind,” Moore reiterated.The credit union, according to Moore, has always worked tirelessly to increase its membership, thereby incorporating visits to workplaces as part of its membership drive.Moore noted, “We have an ageing membership, so we are using various ways and initiatives to attract young people. One such way is that we have been reaching out to our current members and encouraging them to invite their extended family members and friends to join the credit union.“In recent years, we have created Facebook, Instagram and various social media platforms to make ourselves more attractive and visible to the younger demographic,” Moore added.At the end of the day, Moore possess a vision for growth which he longs to see realised.He emphasised, “I’ll like to see the credit union get to the stage where we take a member from a baby, up to an adult. We therefore want parents to invest in their newborns, so we can be there at all the various stages of their lives and assist them with their financial planning throughout each stage.” (CH) RICARDO MOORE, Credit Officer. (SLD)hairman of the Credit Committee of the Light & Power Employees Co-operative Credit Union Limited, Wayde Dottin, believes there are many pivotal roles and responsibilities which the credit union management performs for its members.Key among these is helping members build wealth. However, Dottin holds the view that members still need to be educated on how to go about building that wealth and, overall, be educated on how the credit union movement functions.According to Dottin, “People mostly see the credit union as the place where they can borrow money and as an alternative to commercial banks. It is true that if you are a member of a credit union, it is much easier to access funds based on the membership component. You know that you are among persons with whom you have a lot in common. However, the credit union is there to help members build wealth and become more educated on the roles and function of the credit union movement.”To this end, Dottin wants to see more members pay greater interests in the educational forums and online classes provided by the Barbados Co-operative & Credit Union League Limited.He stressed, “I have found that mostly members of committees access these educational forums. We must therefore find ways of reaching members to encourage them to become more knowledgeable about the credit union movement, as well as encourage them to increase their savings. Many people are still in the dark when it comes to financial planning. The credit unions have a measure of responsibility to help educate them.”A member of the Light & Power Employees Co-operative Credit Union Limited since joining the Barbados Light and Power (BL&P) Company Limited in 1997, Dottin, who is a supervisor in the distribution department, shared, “From the early days, we would encourage anyone joining the company to join the credit union. To this day, we still do this. We encourage them to join and to become more involved as committee members and in managing their finances. They are also encouraged to invite their family members to join the credit union.”As chairman of the Credit Committee, Dottin adjudicates on all loans and ensures that regulatory practices are upheld.He informed that line of credit loans are quite popular within the credit union, as these unsecure loans allow members to borrow up to $25 000.Dottin explained, “Once these loans are approved, members have access to their funds and are able to draw down on these loans as they please. This is normal within most credit unions and is on par with commercial banks which offer credit card services.”He further disclosed that many members also make use of the seasonal summer and Christmas line of credit loans. While vehicular loans are also popular, those for mortgages, according to Dottin, do not occur “in big frequencies”.“We do see loans for mortgages, but not in a large frequency. Business loans, personal loans, medical loans, loans for travel, educational loans and loans for renewable energy purposes are also on offer to members,” Dottin revealed.Dottin sees a bright future for the Light & Power Employees Co-operative Credit Union Limited.He shared, “We are now in our 40th year, and this is a major milestone. From here, I see further growth, rebranding, and the need for more outreach to members. I want to see members go from having loans where no assets are involved, to acquiring loans where assets are involved, so that entrepreneurship-wise, they can create that wealth we speak about. I also want to see members put themselves in the place to become elected members who can serve the credit union. Serving is not as time-consuming as others think.”Together with Dottin, other members of the credit committee are Corey Shockness and Pedro Lawrence.“We usually deliberate as a team and have meetings with members to ensure we have a good understanding of their needs. And while we never set out to deny members access to loans, if we see the need to, we will. This is always done in the best interest of the member and the credit union. When we have to make such a decision, we engage in dialogue with the member and explain the reasons why we chose to take such steps. They too, are invited to have conversations with us,” Dottin explained.At the end of the day, both parties usually reach common ground, which allows them to go forward with a much better and stronger financial footing. (CH)Dottin’s vision for the futureWAYDE DOTTIN, Chairman of the Credit Committee. (SLD)

10DSunday, January 28, 2024Growth worthy of noteINCE JOINING THE Light & Power Employees Cooperative Credit Union Limited in 2004 as a member – some 20 years ago, Roxanne Marks has been impressed with the credit union’s growth.“Over the years, people have gravitated to the credit union, as opposed to the commercial banks. We know our members personally. When anyone calls the credit union, they will always find someone to speak to them and serve them. “The personalised service which we offer is different than that offered by other bigger financial institutions. That makes us different, and we are always willing to have dialogue with our members. In fact, we encourage dialogue,” Marks stressed.One of two member services representatives, Marks is one of the first faces you will meet when you enter the doors of the credit union’s offices at Bush Hill, The Garrison, St Michael. She joined the credit union’s team first as a member, having been invited by a standing member to do so. According to Marks, she has not regretted that decision. Since 2007, she has been an employee of the financial institution. Marks disclosed, “Initially, I only dealt with banks. I was in my 20s when I joined as a member, and this was a relatively new way of saving for me. I found being a member of the credit union to be very interesting. I loved the personalised service, and first used the credit union as a place to save extra cash – besides saving at the bank.”Marks also pointed out, “I found it easier to save with the credit union. One of the reasons was the fact that there wasn’t an automated teller machine service.”For Marks, this means members have no real easy access to their savings, and this can been viewed as a positive.Marks is particularly very pleased, satisfied, and happy with the ease that credit unions in general provide for members to acquire loans.“We know that it is so much easier for persons to get a loan with a credit union than it is with a bank. We offer wonderful interest rates on par with commercial banks, so you can see that it is a very competitive field right now,” she stressed.”As a member services representative, Marks performs quite a number of duties. In addition to receiving and disbursing cash, she handles matters relating to suppliers, and paperwork from the process of depositing cheques, standing orders and fixed deposits. A teller at the credit union, Marks sometimes carries out the functions usually performed by the credit officer and administrative assistant when needed. (CH)ROXANNE MARKS, Member Services Representative. (SLD)IN HIS EYES, the credit union movement in Barbados has come a long way and has done much in accelerate the livelihood of Barbadians and develop the country as a whole. But Malcolm Mayers believes that current restrictions continue to hamper a more “further forward movement” of credit unions.“It would have been good by now for members to be able to write cheques, but that’s not possible. There are other products and services credit unions could also be offering, but I still say credit unions have done well for Barbados’ development and the development of Barbadians,” Mayers shared.One of the longest serving staff members of the Light & Power Employees Co-operative Credit Union Limited, Mayers joined the staff of the credit union back in 1990 as a messenger. He was later promoted to the post of teller, and then to member services officer, a post also referred to as customer service representative.Recalling those early days, Mayers disclosed, “Back then it was challenging, but I got to meet quite a lot of people, and that was really great. Today, it is still very much about keeping focused and offering personalised service. I love meeting new members and interacting with everyone – both internal and external customers. Some days it can still be challenging – perhaps in a different way, but you rise to the occasion to ensure that customers are happy.”Nothing makes Mayers’ day more fulfilling than having satisfied members. Equally thrilling for him is when members compliment him for his excellent service.While he looks back fondly on the early days when only staff members of the Barbados Light & Power (BL&P) Company Limited and their family members were allowed to become members of the credit union, Mayers is extremely pleased that membership is opened to anyone desirous of joining.He stressed, “I was pleased when membership was extended to the public. With competition there must always be change. Today we have to embrace everyone, including young people, and we are always happy to welcome new members.”Mayers disclosed: “I like my job, I love meeting people, and at this stage of my life, I am not going anywhere. I love where I am, and I am comfortable at the Light & Power Employees Co-operative Credit Union Limited.”Mayers performs a plethora of services, including working with the credit union’s team to promote the credit union’s products and services. Ultimately, one of his key goals is to build membership. (CH) MALCOLM MAYERS, Member Services Officer. (SLD)Services offered*EVER CONSCIOUS OF its corporate commitment, The Light & Power Employees Co-operative Credit Union Ltd has always given back to the communities it serves.There is The Trevor Browne Scholarship, which provides financial assistance to its student members or to those students whose parents are members of the credit union. High on the credit union’s agenda is sponsorship of and donations to worthy causes – too many to mention.Together with its social consciousness and the need to give back, the credit union also has many products and services to offer those who become members in a bid to better the livelihood of each member.Here is a look at some of them:JUNIOR SAVERSThe Junior Savers Account is a savings plan designed for children between the ages of 0 – 16 years. Through this account, children can learn the habit of saving, thrift and good money management. Key features and benefits include:• Earn attractive interest rates.• Provides an opportunity for the young members of the family to save today and reap the benefits tomorrow.• The money saved can assist with educational and personal goals.• Special incentives are offered by the credit union from time to time, which include scholarships and bursaries.• Children will develop useful knowledge of the credit union at an early age.• Insurance benefit will be paid to beneficiaries on the death of the member. ORDINARY SHARESThe Ordinary Non-Qualifying Shares Account is the main account for the credit union members. It forms the cornerstone of the members’ relationship with the credit union. The key features and benefits of this account are:• Interest is paid on minimum quarterly balances bi-annually.• Allows the credit union to better assess the member’s ability to borrow.• Insurance benefit will be paid to beneficiaries on the death of the member.• Non-qualifying shares are the primary collateral used to fund and sustain loans.• Share withdrawals (although not encouraged) in cases where members have loans are only allowed under special circumstances and must be authorised by the secretary of the Board of Directors.ORDINARY DEPOSITSThis is an interest-bearing savings account which facilitates the payment of Standing Orders and other financial commitments, including loan repayment.Key features and benefits include:• Interest on balances paid quarterly.• Annual dividend payment is also credited to this account.• Allows for payment of standing orders, loans, and other liabilities.• Insurance benefit will be paid to beneficiaries on the death of the member.SPECIAL FIXED DEPOSITSThis is an account that allows members to earn alternate rates of interest on lump sum deposits. Deposits may be placed for periods of 30, 90 or 360 days. Key features and benefits include:• Receive attractive interest rates.• Provides the opportunity to maintain a set principal while utilising the interest payments as a source of income.• Can be used as a source for retirement savings.• Can be used to attain short- or long-term goals.• Flexibility and variety of saving periods.• Fixed deposit will be automatically rolled for previous term unless otherwise instructed; little maintenance required.• Interest can be transferred into any credit union account of your choice.TERMS SAVINGS PLANThe Term Savings Plan is one of the many services offered to members. It is an attractive savings plan, which focuses on the future financial needs of the members. This savings plan is similar to an instalment savings plan where members can save a fixed amount either weekly or monthly for a specified time up to a maximum period of five years. During the stipulated period of instalment, a very attractive interest rate is paid to the member.STANDING ORDERSA Standing Order is a simple, reliable and economic way of making your credit union loan payments or savings on a weekly/fortnightly or monthly basis. This is also a convenient way to make your monthly insurance payments. To setup a standing order, simply call or visit the credit union, and a member of staff will help you to complete an instruction form that authorises your employer or bank to deduct the amount from your salary or bank account, on a weekly/fortnightly or monthly basis, and pay this amount into your credit union account. (CH)

11DSunday, January 28, 2024and the easy endorsement of persons to become members are hallmarks of the Light & Power Employees Co-operative Credit Union Limited, which Member old financial institution.She is also always keen to inform that the credit union’s overall products and services are very attractive.service for purposes such as small home repairs and travel. We also have to offer.”joined the team at the Light & Power Employees Co-operative Credit Union Limited on April 1, 1995. She started as the confidential credit union’s other business interests – namely the former Esso worker.decades.(CH)Daniel: We have so much to offerBERNADINE DANIEL, Member Services Supervisor. (SLD)CO-OPERATORS GENERAL INSURANCE CO. LTD.Insurance the way you want it to be!BRANCH #1:Northern Business Centre, Speightstown, St. PeterTel: 422-5106Opening Hours:Mon-Fri 8:30a.m - 4:30 p.m.Saturdays closed.BRANCH #2:Emerald City, Six Roads, St. PhilipTel: 271-1227Opening Hours:Mon-Fri 8:30a.m - 4:30p.m.Saturday 9:00a.m -1:00p.m.HEAD OFFICE:Upper Collymore Rock, St. MichaelTel: 431-8600 • Fax: 430-9148Flexi Opening Hours:Mon - Fri. 7:30 a.m. - 5:30 p.m.Sat. 9:00am - 1:00pm

12DSunday, January 28, 2024